Here, in this post we will deal with both forward contract and futures. I will first explain the forward contract accounting and hedging, and then deal with futures accounting and hedging.

Forward Contract

Worth or FMV of a Forward Contract

While the forward contract is formed it is worth less. Its FMV is Zero. As it moves towards expiry, it will have a value depending on the position of the spot price, with respect to the forward price, the probability of the spot price movement and the proximity of the expiry. Some forward contracts like some futures contract do not have an FMV through out it's life, as they are settled on a daily basis. As you read on you will know the reasons why.

Simple Forward Contracts

A Forward Contract is an agreement between two parties, a buyer and a seller, in which the seller agrees to sell a certain quantity of a commodity for a certain price in a future date to the buyer, regardless of the price of the commodity at the time of the beginning of the contract or in the future date. The buyer in turn agrees to purchase the same quantity of commodity for the same price at the same date, specified in the contract, regardless of the price of the commodity at the time of the beginning of the contract or in the future date.

The current price of a commodity at any point of time is called the spot price.

Premium Situation

Consider a trading company which is about to enter into a forward contract with one of it's customers. The company had procured 1 ton of commodity for $7000 per tonne,for trading purposes on

1-Jan-2017. On 1- July- 2017, the spot price of the commodity becomes $10000 per tonne. The company do not expect the price to move much forward beyond $12000 in 3 months time. So it enters into a forward contract on 1-Jul-2017 with a customer who thinks it will go much beyond.

While procuring, the company had made the following accounting entry.

On 1-Jan-2017

On 1-Jan-2017

The forward contract stipulates that the company agrees to sell 1 tonne of the commodity at $12000 per tonne, on 1-Oct-2017, to the customer whatever the spot price at that time is. The customer has agreed to purchase 1 tonne of the commodity at $12000/tonne on 1-Oct-2017, whatever the spot price is at that time.

On 1-July-2017, when the forward contract is formed, the seller makes the following accounting entry.

On 1-July-2017, when the forward contract is formed, the buyer makes the following accounting entry.

On Oct 1st, when the contract actually comes in force, the seller makes the following entries.

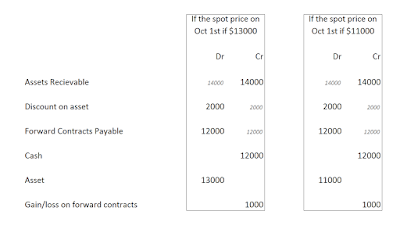

I have shown the entries for two scenarios.

1. If the spot rate on Oct 1st is $11000

First of all the forward contract entries are cancelled out in the first three entries. The fourth entry shows the cash receipt of $12000. In the fifth and sixth entry, the asset is revalued to the spot price of $11000, recognizing a gain of $4000 over the purchase price of $7000. The last two entries shows the sale of asset for the spot price on Oct 1st of $11000, and a gain of $1000, as the forward price is $12000, and as the customer has to pay $12000 for a $11000 asset.

2. If the spot rate on Oct 1st is $13000

Again all the forward contract entries are cancelled out in the first three entries. The fourth entry shows the cash receipt of $12000. In the fifth and sixth entry, the asset is revalued to the spot price of $13000, recognizing a gain of $6000 over the purchase price of $7000. The last two entries shows the sale of asset for the spot price on Oct 1st of $13000, and a loss of $1000, over the forward price of $12000, as the customer has only to pay $12000 for a $13000 asset.

On Oct 1st, when the contract actually comes in force, the buyer makes the following entries.

Again here, I have shown the entries for two scenarios.

1. If the spot rate on Oct 1st is $11000

First of all the forward contract entries are cancelled out in the first three entries. The fourth entry shows the cash payment of $12000. The fifth and sixth entry shows the purchase of asset for the spot price on Oct 1st of $11000, and a loss of $1000, as the forward price is $12000, and as the customer has to pay $12000 for a $11000 asset.

2. If the spot rate on Oct 1st is $13000

Again, all the forward contract entries are cancelled out in the first three entries. The fourth entry shows the cash payment of $12000. The fifth and sixth entry shows the purchase of asset for the spot price on Oct 1st of $13000, and a gain of $1000, as the forward price is $12000, as the customer has only to pay $12000 for a $13000 asset.

Discount Situation

Consider a case in which the spot price on July 1 became $14000. And the company which procured the commodity at $ 7000 believes that the price will go down well beyond $12000 in 3 months. So it forms a forward contract with a buyer for $12000, with expiry date on Oct 1, who thinks that the price wouldn't go down at all.

On 1-July-2017, when the forward contract is formed, the Buyer makes the following accounting entry.

On Oct 1st, when the contract actually comes in force, the seller makes the following entries.

I have shown the entries for two scenarios.

1. If the spot rate on Oct 1st is $13000

First of all the forward contract entries are cancelled out in the first three entries. The fourth entry shows the cash receipt of $12000. In the fifth and sixth entry, the asset is revalued to the spot price of $13000, recognizing a gain of $6000 over the purchase price of $7000. The last two entries shows the sale of asset for the spot price on Oct 1st of $13000, and a loss of $1000, as the forward price is $12000, and as the customer has to pay only $12000 for a $13000 asset.

2. If the spot rate on Oct 1st is $11000

Again all the forward contract entries are cancelled out in the first three entries. The fourth entry shows the cash receipt of $12000. In the fifth and sixth entry, the asset is revalued to the spot price of $11000, recognizing a gain of $4000 over the purchase price of $7000. The last two entries shows the sale of asset for the spot price on Oct 1st of $11000, and a gain of $1000, on the forward price of $12000, as the customer has to pay $12000 for a $11000 asset.

On Oct 1st, when the contract actually comes in force, the buyer makes the following entries.

Again here, I have shown the entries for two scenarios.

1. If the spot rate on Oct 1st is $13000

First of all the forward contract entries are cancelled out in the first three entries. The fourth entry shows the cash payment of $12000. The fifth and sixth entry shows the purchase of asset for the spot price on Oct 1st of $13000, and a gain of $1000, as the forward price is $12000, and as the customer has to pay only $12000 for a $13000 asset.

2. If the spot rate on Oct 1st is $11000

Again, all the forward contract entries are cancelled out in the first three entries. The fourth entry shows the cash payment of $12000. The fifth and sixth entry shows the purchase of asset for the spot price on Oct 1st of $13000, and a loss of $1000, as the forward price is $12000, and the customer has to pay $12000 for a $11000 asset.

The amortization of premium or discount will be dealt with, in the next topic.

Hedging with Forward Contracts

In order to better explain the concept of hedging, I am saving the mechanics of hedging after analyzing an example first.

Let us start with an example, straightaway and try to explain the concept of Hedging by the way of Currency Futures. As the most traded currency futures pair is EURUSD, we will see an example which deals with EURUSD futures.

A company ABC Ltd, based in New York, sells a product to XYZ Inc which is based in London and ships it on 1st Jun 2017on three months credit. It sells the same product in the US market for $120000. Since the spot rate of EURUSD currency pair on 1st Jun 2017 is 1.20, it prices the product EUR 100000 for it's European customer. The settlement is on 1st September 2017. At the same time, in order to hedge the transaction, ABC Ltd enters into a forward contract to sell EU 100000 on 1st September 2017 to a currency dealer at a forward rate of EURUSD as stipulated in the forward contract. The dealer will send the corresponding dollar amount as agreed in the contract at the time of expiry on Sept 1. At this point we look at multiple scenarios. The balance sheet date for ABC Ltd is on 30th Jun 2017. We will consider following cases.

If it's an exclusive forward contract

Now let us do the accounting entries as if the company has entered into an exclusive forward contract with a currency dealer. For the sake of simplicity, I am showing only the entries of the seller, ABC Ltd.

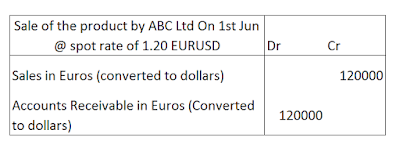

Now since the product is physically delivered to the customer, ABC Ltd records a sale on 1st Jun 2017.

The accounting entry for sale on 1st Jun 2017 is

Also, ABC Ltd makes the following entry for the recognition of the forward contract on 1st Jun 2017.

Amortization of the Premium/Discount on the balance sheet date

On the balance sheet date, the premium or the discount on the balance sheet is always amortized and a revenue or a loss is recognized. The amortization can be calculated using various methods, which we are not going into, now.

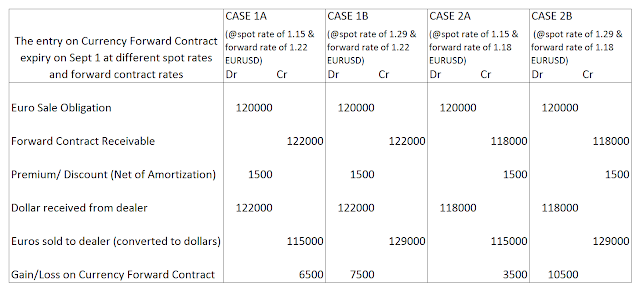

1. On 1st September, ABC Ltd transfers EUR 100000 to the currency dealer, which is also recorded after converting to dollars on the spot rate. This is shown in the 6th line of the forward contract entries. The dealer in return sends dollars according to the forward rate in the contract. This is shown in the 5th line of the forward contract entries. On the receipt of cash, the forward contract entries are closed and a foreign exchange gain or loss is recognized.

2. On 1st September, XYZ Ltd pays cash of EUR 100000 to ABC Ltd. But it has to be recorded in dollars depending on the spot rate at that time. This is shown in the 1st line of the Cash from sale entries.

Analysis

Let us look at the total foreign exchange gain or loss for ABC Ltd on 1 Sep 2017.

Case 1A

In this case the forward rate entered on Jun 1st is 1.22 and spot rate at expiry is 1.15. While entering the forward contract on Jun 1st, ABC Ltd demanded that for each euro, he should receive $0.02 as a premium. The premium is calculated based on the market sentiment, and the proximity to the date of expiry. Clearly, ABC Ltd should have expected the dollar to depreciate and the dealer, the other way.

At expiry, ABC Ltd made a total foreign currency gain of $2000, even though the dollar appreciated quite further.

ABC Ltd made a gain of $7000 on forward contracts including the accrued revenue. This can be correlated as selling EURUSD currency futures at 1.22 and closing the position at 1.15, which we will see later. They also made a loss of $5000 on the sale due to currency appreciation. Ultimately they received the premium in the forward contract as gain in foreign currency.

Case 1B

In this case the forward rate entered on Jun 1st is 1.22 and spot rate at expiry is 1.29. While entering the forward contract on Jun 1st, ABC Ltd demanded that for each euro, he should receive $0.02 as a premium. Clearly, ABC Ltd should have expected the dollar to depreciate and the dealer, the other way.

At expiry, ABC Ltd made only a total foreign currency gain of $2000, even though the dollar depreciated quite further.

ABC Ltd made a loss of $7000 on forward contracts including the accrued revenue. This can be correlated as selling EURUSD currency futures at 1.22 and closing the position at 1.29, which we will see later. They also made a gain of $9000 on the sale due to currency appreciation. Ultimately they received the premium in the forward contract as gain in foreign currency.

Case 2A

In this case the forward rate entered on Jun 1st is 1.18 and spot rate at expiry is 1.15. While entering the forward contract on Jun 1st, ABC Ltd accepted that for each euro, he should give a discount of $0.02 to the dealer. The discount is calculated based on the market sentiment, and the proximity to the date of expiry. Clearly ABC Ltd should have expected the dollar to appreciate and the dealer, the other way.

At expiry, ABC Ltd made a total foreign currency loss of $2000 only, even though the dollar appreciated quite further.

ABC Ltd made a gain of $3000 on forward contracts including the accrued expense. This can be correlated as selling EURUSD currency futures at 1.18 and closing the position at 1.15, which we will see later. They also made a loss of $5000 on the sale due to currency appreciation. Ultimately they lost the same amount as that of the discount in the forward contract as loss in foreign currency.

In this case the forward rate entered on Jun 1st is 1.18 and spot rate at expiry is 1.19. While entering the forward contract on Jun 1st, ABC Ltd accepted that for each euro, he should give a discount of $0.02 to the dealer. Clearly ABC Ltd should have expected the dollar to appreciate and the dealer, the other way.

At expiry, ABC Ltd made a total foreign currency loss of $2000, even though the dollar depreciated quite further.

ABC Ltd made a loss of $11000 on forward contracts including the accrued expense. This can be correlated as selling EURUSD currency futures at 1.18 and closing the position at 1.29, which we will see later. They also made a gain of $9000 on the sale due to currency appreciation. Ultimately they lost the same amount as that of the discount in the forward contract as loss in foreign currency.

Summary

1. If we sell a product in a foreign currency while we record our statement in dollars, you need to sell the equivalent amount of foreign currency in which the product is priced, in exchange for dollars, using a forward price.

2. The forward price used for hedging depends on the spot market, the market sentiments and the date of expiry.

3. The foreign exchange gain or loss for a company is only equivalent to the discount or premium on the forward contract and does not depend on the spot rate of currency rates at the time of the expiry. And that itself is the whole point of hedging.

Mechanics of Hedging

In the example, ABC Ltd sells the product in the US market for $120000. $120000 represents the value of the product, after all the costs and a profit for the effort. When the company sells the product in a foreign country in Euros, the customer pays the company EUR 100000 for a $120000 product, after 3 months.

If you think about it, the company is actually selling $120000 and receiving EUR 100000 after 3 months. And after 3 months the value of EUR 100000 may not be $120000, as we have seen in various cases in the example. So in order to hedge the vagaries of the foreign currency value with respect to the native currency, the company takes an opposite position of the foreign currency transaction by using a forward contract or futures (which we will see in a while). Since it will buy EUR 100000 in 3 months for $120000, it will sell EUR 100000 in 3 months to a different entity for $100000. But a premium or a discount becomes unavoidable in hedging, which ultimately becomes the gain or loss in foreign exchange.

Hedging with Currency Futures

You must have guessed that the Futures are very much related to Forward contracts. The Futures are in fact Forward Contracts traded in an organized exchange, on a massive scale. One of the major differences between Futures and Forward Contracts is that, the underlying commodity is not physically exchanged between a buyer and a seller at the expiry of the Futures Contract. Instead, the difference between the Futures price and the spot price is settled by the exchange with the buyer and the seller.

Please read my blog on the mechanics of futures https://finaccfundas.blogspot.in/2018/01/very-basic-tutorial-for-futures.html

Please read my blog on the mechanics of futures https://finaccfundas.blogspot.in/2018/01/very-basic-tutorial-for-futures.html

As explained before, for hedging a foreign currency transaction we take the opposite position of the transaction in a forward contract. In futures also we do the same.

Let us take the same example that we used in hedging of currency sing forward contracts. For ease, I will reproduce the example

If you have read my blog on futures, you will understand that the futures rates are marked to market on a real time basis, and the settlement is also real time. However the company cannot transfer the Gain/Loss in the currency futures along with the margin money from it's trading account to it's bank, until it either closes the position or at expiry. However the company has to enter certain accounting entries on the date of balance sheet.

Since the company shorted EURUSD, in both CASE 1 and CASE 2, there is going to be a Gain/Loss in derivative transactions and a Gain/Loss in foreign exchange on sales. Though it is a non cash gain/loss, it has to be reported on the balance sheet date.

Since the company sold 120000 dollars (the product is manufactured by spending dollars and the mark up for the effort also is in dollars) to purchase 100000 Euros ( Customer pays in Euros). And we converted the accounts receivable entry from 100000 Euros to 120000 dollars. Now on Jun 30th, the dollar changed .

So we need to re translate the accounts receivables to changed dollar value.

The calculations for these gains and losses are shown in the table below

The re translation entries are

For recording derivative Gains and Losses, we calculate the difference between the current futures rate and the rate at which the futures is shorted. Multiply by the lot size. This gives you the total of all the credits and debits, which gives the profit/loss on the trade. Please read my blog on futures.

This profit/loss, though in paper, the company can claim any time, by closing the positions or at expiry. So it can always create a receivable, if its a profit in the trade, or a payable, if its a loss in the trade. We call these receivables as derivative assets and payables as derivative liabilities. Once the company takes the payout, if it's a profit or pays in if its a loss, after it either closes the account or at expiry, we settle the cash payout/pay ins against these assets/liabilities respectively. This can be seen as you read on.

Derivative Gain/Loss entries are

Now on Sept 1st all the four cases have different spot rates which is equal to the futures rate at expiry on Sept 1. Again we re translate the accounts receivable and record derivative gain loss.

The calculations are as follows

For re translation of accounts receivable.

For recording derivatives Gain/Loss

Recap

These are the steps we have taken till now.

1. We record the sale of the product priced EUR 100000 in dollars $120000 using the spot rate of 1.20 EURUSD on Jun 1st.

2. On Jun 30th, since it is the balance sheet date, we record foreign currency gain on the accounts receivable (cash receivable for sale in Euros expressed in dollars). This is done by re translating the accounts recievables, using the spot rates on Jun 30th, for the four different cases.

3. We create a derivative asset/ liability, which is a receivables/ payables entry for the paper gain/loss in the trading account, and record a derivative gain loss using the existing futures rates for the four different cases on June 30th.

4. At the time of expiry we again re traslate the accounts receivable using the then spot/futures rate as both will be the same, and also again update the derivative assets. liabilities for the paper gain/loss on the expiry close.

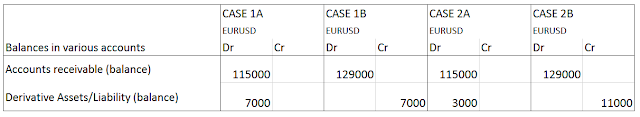

Now let us check the balances in assets receivables, and derivative assets/liabilities accounts after all these entries

Also let us check what the company can take out for profit in trade or what the company needs to compensate if it's a loss once futures expired.

Final Settlement Entries

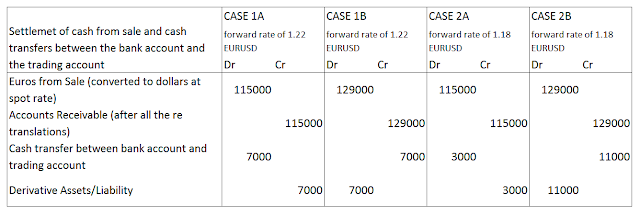

Now once the cash is received from the customer in Euros on Sept 1, it is converted to dollars @ the spot rate and closed against Accounts Receivables. Then the cash is transferred between the trading account and the bank account, and is closed against the derivative assets and liabilities

Gain/Loss Comparison between hedging using a bespoke currency forward contract and Currency Futures

Now let us see the net Gain/Loss in hedging using Currency Futures

Now let us compare it with Gain/Loss in hedging by using a bespoke currency forward contract, I am reproducing the chart here.

The net result is the same.

Conclusion

A company can choose to hedge it's transactions using bespoke forward contracts or by using Currency Futures. Either way the results will be similar. The choice really depends upon other ancillary charges such as brokerage, taxes etc.

Let us take the same example that we used in hedging of currency sing forward contracts. For ease, I will reproduce the example

A company ABC Ltd, based in New York, sells a product to XYZ Inc which is based in London and ships it on 1st Jun 2017 on three months credit. It sells the same product in the US market for $120000. Since the spot rate of EURUSD currency pair on 1st Jun 2017 is 1.20, it prices the product EUR 100000 for it's European customer. The settlement is on 1st September 2017. At the same time, in order to hedge the transaction, ABC Ltd sells 1 lot of EURUSD futures on 1st September 2017 . At this point we look at multiple scenarios. The balance sheet date for ABC Ltd is on 30th Jun 2017. We will consider following cases.

On Jun 1st ABC Ltd makes the following entry for sales

Since the company shorted EURUSD, in both CASE 1 and CASE 2, there is going to be a Gain/Loss in derivative transactions and a Gain/Loss in foreign exchange on sales. Though it is a non cash gain/loss, it has to be reported on the balance sheet date.

Since the company sold 120000 dollars (the product is manufactured by spending dollars and the mark up for the effort also is in dollars) to purchase 100000 Euros ( Customer pays in Euros). And we converted the accounts receivable entry from 100000 Euros to 120000 dollars. Now on Jun 30th, the dollar changed .

So we need to re translate the accounts receivables to changed dollar value.

The calculations for these gains and losses are shown in the table below

The re translation entries are

This profit/loss, though in paper, the company can claim any time, by closing the positions or at expiry. So it can always create a receivable, if its a profit in the trade, or a payable, if its a loss in the trade. We call these receivables as derivative assets and payables as derivative liabilities. Once the company takes the payout, if it's a profit or pays in if its a loss, after it either closes the account or at expiry, we settle the cash payout/pay ins against these assets/liabilities respectively. This can be seen as you read on.

Derivative Gain/Loss entries are

The calculations are as follows

For re translation of accounts receivable.

For recording derivatives Gain/Loss

Recap

These are the steps we have taken till now.

1. We record the sale of the product priced EUR 100000 in dollars $120000 using the spot rate of 1.20 EURUSD on Jun 1st.

2. On Jun 30th, since it is the balance sheet date, we record foreign currency gain on the accounts receivable (cash receivable for sale in Euros expressed in dollars). This is done by re translating the accounts recievables, using the spot rates on Jun 30th, for the four different cases.

3. We create a derivative asset/ liability, which is a receivables/ payables entry for the paper gain/loss in the trading account, and record a derivative gain loss using the existing futures rates for the four different cases on June 30th.

4. At the time of expiry we again re traslate the accounts receivable using the then spot/futures rate as both will be the same, and also again update the derivative assets. liabilities for the paper gain/loss on the expiry close.

Balances in various accounts

Also let us check what the company can take out for profit in trade or what the company needs to compensate if it's a loss once futures expired.

Final Settlement Entries

Now once the cash is received from the customer in Euros on Sept 1, it is converted to dollars @ the spot rate and closed against Accounts Receivables. Then the cash is transferred between the trading account and the bank account, and is closed against the derivative assets and liabilities

Gain/Loss Comparison between hedging using a bespoke currency forward contract and Currency Futures

Now let us see the net Gain/Loss in hedging using Currency Futures

Now let us compare it with Gain/Loss in hedging by using a bespoke currency forward contract, I am reproducing the chart here.

The net result is the same.

Conclusion

A company can choose to hedge it's transactions using bespoke forward contracts or by using Currency Futures. Either way the results will be similar. The choice really depends upon other ancillary charges such as brokerage, taxes etc.

I loved the article.

ReplyDeleteOnce Go through the article

Difference between Forward Contract and Future Contract

Great!

ReplyDeleteThanks for sharing this article!

Read more about forward contract

Thanks For sharing such a nice post.

ReplyDeleteDynode Software is one of the highest recommended top web development company in Patna and one of the top digital marketing company in the industry. Dynode Software has used the same strategies they use for clients to become a four-time Inc. 8000 company (2017, 2018, 2019 and 2020). Dynode Software offers best-in-class SEO, paid media, social media, email marketing, creative, development, Amazon and CRO.

This is so amazing article very informatic information for me .you can also benefit for my

ReplyDeletequickbooks customer service number

and also call at (888) 210-4052

I just found this blog and have high hopes for it to continue. Keep up the great work, its hard to find good ones. I have added to my favorites. Thank You. kündigen

ReplyDeleteHi,

ReplyDeleteYour blog is amazing. You have provided so much details about accounting, finance, first party collections and account receivable collection company. I enjoyed reading it so much. Thanks for your efforts.

This made me want to explore more artisan luxury brands. 77raja

ReplyDeleteFederal tax credits help maximize profits. R&D tax credits

ReplyDelete