A simple table to understand the difference between various types of leases

CAPITAL

LEASE

(i) FINANCE LEASE

In a finance lease, a leasing entity (the lessor or the owner)

buys the asset for a user ( the lessee or the hirer), rents it to the user for

an agreed period. The user pays a rent periodically for the usage of the asset.

The payment terms are all according to the lease contract. A lease is considered to be finance lease

if:-

Either

The present value of all future rent payments is more than 90% of the FMV of the asset at date of lease inception

The present value of all future rent payments is more than 90% of the FMV of the asset at date of lease inception

Or

The lease is for more than 75% of the life of the asset

Or

The lease agreement allows the transfer of ownership to the user

at the end of the lease term

Or

The lease agreement allows for a bargain purchase of the asset

for the user at the end of the lease term.

The basic difference between a finance lease

and an operating lease is that the asset is shown in the users balance sheet in

a finance lease vis a vis an operating lease where the asset is shown in the

owners balance sheet. Mind you, in both types, the owner legally owns the

asset. Technically, the owner transfers substantially, the risks and rewards of

the ownership to the user in case of the finance lease.

Why

is it called a finance lease? The owner expects an interest on the leased value

of the asset. The user will pay equated installments of lease payments, which

will have a principal component and an interest component. The equated

installments will be calculated using a target rate of return agreed by

the owner and the user. Whereas, in an operating lease, the profit for the

owner comes from the rent payments and the resale value of the asset.

Now let us see an example

A leasing firm leases a machine to a user for 4 years starting January 1st of the year. The cost, as well as the transfer price is the same $ 50000. The first lease payment is immediate, on January 1st itself, with 3 more lease payments expected. The machine has an estimated life of 4 years. The owner expects a 10% return on his lease.

A leasing firm leases a machine to a user for 4 years starting January 1st of the year. The cost, as well as the transfer price is the same $ 50000. The first lease payment is immediate, on January 1st itself, with 3 more lease payments expected. The machine has an estimated life of 4 years. The owner expects a 10% return on his lease.

Here the equated lease installment amount is

calculated as 50000/present value of annuity due. 10%, 4 periods

=50000/3.487

=$14339

If we multiply 14339 into 4, we get $57356.

Therefore the owner makes a profit of $7356 throughout the lease term, which is

the interest part.

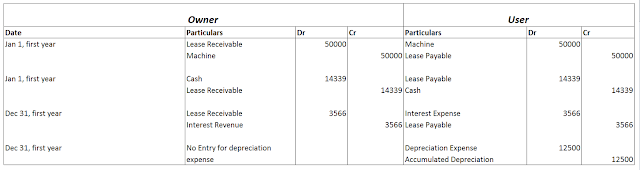

The accounting entries are.

The accounting entries are.

Now let's see the amortization table.

For finding the interest for the year, we use the 10% target rate of the owner. Since the first payment is received early in the year, the interest at the end of the year is (50000-14339) x 10%

So the profit of $7358 for the owner purely consists of the interest on the lease outstanding at his target rate of 10%

(ii)SALES TYPE LEASE

In simple words, a sales lease is only a finance lease,

except the owner makes an initial profit over the cost of the asset when the lease

starts. In other words, the lease amount is greater than the cost of the

asset. It can also be said that the present value of all the future payments

will be greater than the cost of the asset.

Let us look at the earlier example:

If the transfer price is set to $60000, that is $10000

more than the cost price of $50000

The accounting entries are

How did we get the figure of $17207 as the lease installment amount?

Though the owner recognized a gain of $10000 in the accounting entry, it is a

non cash gain. Where does he finally realize the cash of $10000 gain? It is along

with the lease installments.

Here the equated lease installment amount is

calculated as 60000/present value of annuity due. 10%, 4 periods

=60000/3.487

=$17207

If we multiply 17207 into 4, we get $68830.

Therefore, the owner makes a profit of $18830 throughout the lease term, which

is the interest part plus the profit of $10000.

It will be much clearer if we look at the amortization entries.

It will be much clearer if we look at the amortization entries.

So the profit of $18830 for the owner purely consists of the interest on the lease outstanding at his target rate of 10% plus the profit of $10000

OPERATING

LEASE

In an operating lease, same as the capital lease, a leasing

entity (the lessor or the owner) buys the asset for a user (the lessee or the

hirer), rents it to the user for an agreed period. The user pays a rent

periodically for the usage of the asset. The payment terms are all according to

the lease contract. The difference is that:

1.

The lease term is considerably less than the life of the asset so that the asset

retains a resale value at the end of the lease term

2.

The owner makes profit from the rent revenue stream. He may re-lease

it to different parties at the end of each lease term. He may get good resale

value too, once he is done with leasing.

3.

The asset remains in the balance sheet of the owner. The owner

has to ensure that the resale value of the asset is not affected by use. The

material risks and rewards lies with the owner.

This residual value is forecast at the start of the lease and

the owner takes the risk that the asset will achieve this residual value or not

when the contract comes to an end.

An operating lease is more typically found where the assets do

have a residual value such as aircraft, vehicles and construction plant and

machinery. The customer gets the use of the asset over the agreed

contract period in return for rental payments. These payments do not

cover the full cost of the asset as is the case in a finance lease.

Operating leases sometimes include other services built into the

agreement, e.g. a vehicle maintenance agreement.

Ownership of the asset remains with the user and the asset will

either be returned at the end of the lease, when the leasing company will

either re-hire in another contract or sell it to release the residual

value. Or the user can continue to rent the asset at a fair market

rent which would be agreed at the time.

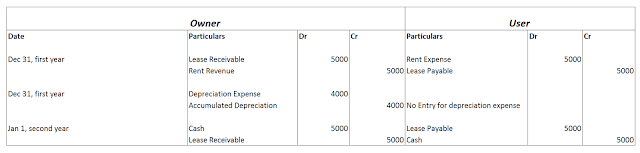

Let us consider an example

A leasing company leases a machine for an agreed upon yearly

rent of $5000. The cost of the machine for the owner is $12000. The lease

period is for 3 years. The agreement starts on Jan 1st of the year.

The rent payment is expected at the beginning of the next year on wards.

Accounting entries are

If the owner had insisted on prepaying the whole rent at the

beginning of the year itself

Accounting entries are.