These are the rules compiled from the text, Technical Analysis Of The Financial Markets by John Murphy. I have taken pains to compile these rules, for my own personal use. But I have also published it so that, others can gain from it. It is most recommended to read the full text by John Murphy before going through this material.

All the figures are edited and used from the book-Technical Analysis Of The Financial Markets by John Murphy

TRENDLINES

1. Wait for the prices to close 3% below the trendline, to confirm a trendline breach.

2. Along with rule 1, wait for the prices to close below the trendline for atleast two consecutive days, to confirm a breach of the trendline.

3. While using trendline fans, the third line breach is considered to be a valid trend reversal.

3. After the breach, the price of a security generally tend to move upto the same distance in the opposite direction of the trend, as the last top or bottom. If a channel is present, then the width of the channel is the distance upto which, the prices will move, once the basic trendline is breached.

5. Most important and healthy trend lines follows a slope of 45°. If there are steeper lines, they might finally be breached and corrected to a 45° trend line. And if there is a shallow trendline, the trend might either be not valid or will gather steepness over time.

6. Even if there is a trend, a channel may not exist.

RETRACEMENT

1. The retracement levels according to dow theory are 33%, 50% and 66%.

2. The retracement levels from the dow theory can be combined with Fibonacci retracements of

38.2%, 50%, 61.8% to form ranges of retracements as 33-39% and 62-66%.

REVERSALS

1. A reversal happens when a new top is reached in an uptrend, but the prices finally close below the previous close. Or, when a new bottom is reached in a downtrend, but the prices closes above the previous close.

2. This can happen in any time frame, but when the price reversal happens on fridays in a weekly time frame, or on month ends in a monthly time frame, then the significance increases.

3. On the reversals if volume is is especially high, then it might indicate a trend reversal or atleast an intermediate correction.

GAPS

1. Weekly and monthly gaps are very significant, but occur rarely. Some gaps are filled and some are not. The three types of gaps given below, when satisfied with certain other conditions, are most likely not filled.

2. A break away gap occurs after an important price pattern is completed ( like Head and Shoulders ) and the resistance is finally broken or, when a major trend line is broken due to a trend reversal.

3. If accompanied by heavy volume, break away gaps are most likely not filled.

4. Break away gaps form a significant trend support, the trend which the gap already started.

5. A close below the Breakaway gap, while in an uptrend, usually signifies weakness and a trend reversal.

RUNAWAY OR MEASURING GAP

6. A measuring gap occurs almost in the middle of a trend. It confirms the smooth continuation of the trend.

7. Measuring gap also acts as supports and are most likely not filled. And if at all, when filled, can signify a trend reversal.

8. This occurs as a last gasp, at the end of the trend.

9. It is confirmed, when the prices finally closes below the gap after a few days or weeks of the occurrence.

10. Once the gap level is broken, a significant trend reversal can be expected.

11. Sometimes the gap level is broken with another breakaway gap, in the opposite direction. As a result, the price movement between the exhaustion gap and the subsequent break away gap looks like an island. When an island reversal happens, a trend shift can be expected.

Note that the island formed on the top usually contains more than one price bar ( In the figure above, there is only one price bar in the island area )

REVERSAL PATTERNS

The price picture patterns are used to predict what happens, after a trendline is broken and the market moves side ways; whether the market moves sideways or the trend reverses.

GENERAL RULES

1. The major reversal patterns are Head and Shoulders, Double/Triple tops and bottoms, V (spike) tops and bottoms and Rounding (saucer) patterns.

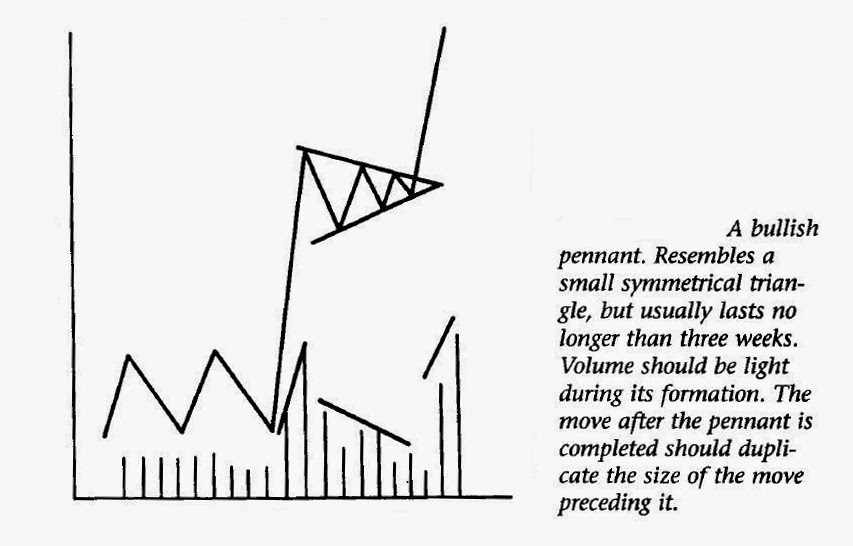

2. The major continuation patterns are triangles, flags, pennants, wedges and rectangles.

3. Volume levels are used in confirming the indications of these patterns.

4. These patterns can also be used to measure the extent of the subsequent movements.

5. A prior trend should exist as a prerequisite.

6. A major trendline needs to be broken before the pattern manifests.

7. Larger the pattern, the more significant it becomes, and greater the subsequent price movement.

8. Topping patterns are shorter, more volatile and fast forming while bottoming patterns takes time to form and are less volatile.

9. Therefore, though bottoming patterns are less risky, topping patterns are more rewarding, as prices falls faster than they build up.

10. Sometimes, the breaking of a major trendline coincides with the completion of a price pattern.

11. The completion of price pattern should accompany an increase in volume, especially in bottoms.

12. If volume do not increase during an upside break out, then the pattern cannot be trusted.

HEAD AND SHOULDERS PATTERN

1. Most of the other reversal patterns are a variation of H & S pattern.

2. Volume expands on reaching each new crests, and contracts on each new troughs, before the pattern starts to form ( before the trend loses steam ).

3. When the left shoulder starts to form, the volume may get lighter than the previous crests. This is an indication that the trend is losing steam, and a pattern formation can be anticipated.

4. When trend line is broken, there is a possibility of a H&S formation. Volumes get increasingly lighter on crests and increasingly heavier on subsequent troughs.

5. Formation of point E below the highest peak of point C, is when the trader starts to prepare for a position. When this happens, its almost sure that a sideways movement has started, and liquidation of long positions may be wiser. By this time a Neck line can be drawn.

Neckline and Subsequent actions.

a) The H&S pattern is confirmed when the neckline is broken.

b) Neck line is the new trendline, drawn after the sideways movement starts. A return move on lighter volume with peak at point G can be expected if the neckline is broken with not so heavy volume. If the neck line is broken with very heavy volumes, a return move may not be there or a small return may occur.

c) Either a 1-3% close below the neckline or two successive closes below the neckline, has to be used as a criteria for the H&S formation confirmation. Other wise, resumption of the uptrend can happen.

d) Though volume can be lighter in the second peak ( Head part ) it has to be lighter on the third peak ( Right shoulder ). The volume should be heavier while the breaking of the neck line, and should be lighter again on the return move, and should increase again, on the subsequent downward move. The volume has to pick up at some point in the down trends, AT THE LEAST.

e) Since neck line is a sideways trend, the minimum target for profit booking, is always the width of the trend, in this case, the height of the head from the neckline. ie, the prices are most likely to move below the neckline, the same distance as the height of the head from the neck line. Maximum target depends upon the support levels, retracement levels etc. Minimum price target should also be adjusted to price support levels.

f) The slope of the neck line is slightly upward in case of a top H & S and slightly downward in case of an inverse H& S. However exceptions do occur.

Inverse H & S pattern

a) The main difference between the topping and bottoming pattern is volume. A reversal from any downtrend happens only when there is absolute demand. The markets should trade on very heavy volumes when the trend reversal happens, when new peaks are reached, especially when the neck line is breached. Whereas, the market prices may fall on inertia alone ( lack of demand or direction ) on market tops. The volume is absolutely critical on reversal on inverse H & S. If not, it is risky to take trades on bottom reversals.

b) The resulting new uptrend should also be on heavier volumes.

c) There is a greater tendency for a return move.

Complex H&S Patterns

a) There might some times be a formation of a double head, or double shoulders.

b) If double left shoulders are present, then double right shoulders also have to be present.

TRIPLE TOPS AND BOTTOMS

1. These are actually a slight variation of H&S pattern and are rarer.

2. All the rules for head and shoulders pattern should be followed.

DOUBLE TOPS AN BOTTOMS

1. This kind of pattern follows the same rules as the H& S pattern except those mentioned below.

2. Point B price level acts as the neckline here. The breaking of this line accompanied by heavy volume confirms the pattern.

3. There is no right shoulder for this pattern, and therefore, after the second peak (The head as in H&S) is formed, and when the neckline is broken ( Point B support), the pattern is completed.

False Double Tops

In order to avoid false double tops the following rules needs to be followed

a) In an uptrend or down trend, sometimes, consequent peaks or troughs may be of the same level, which is quite normal as shown in the fig below

b) Volume pattern should be exactly followed as of H&S pattern.

c) The neckline has to be broken with higher volume, to confirm the pattern as shown in the figure below.

d) The More the gap between the two peaks, the more probable for the reversal.

e) Some times, a close of 1-3% above the first peak level, or a two consecutive close, are used to filter out the false break outs. But Volume pattern will filter out most of the false break outs.

SAUCER

1. They are slow and gradual in forming.

2. They might span several years. It is difficult to predit how long it takes to form the pattern or how far the prices will move in the opposite direction.

3. The longer it takes, the more significant it becomes.

SPIKES

1. They happen, when the market gets over extended and a sudden adverse news cause the prices to fall very abruptly.

2. A daily or weekly reversal accompanied by heavy volume is sometimes the only warning.

ASCENDING AND DESCENDING TRIANGLES AS TREND REVERSAL PATTERNS

Please look at the end of the descending triangles discussion.

WEDGE REVERSAL PATTERN

Please look at the end of the Wedge pattern discussion.

CONTINUATION PATTERNS

GENERAL RULES

1. Continuation patterns are usually formed in short or intermediate time duration.

2. Sometimes, some of the continuation patterns can act as reversal patterns in special cases.

3. Volume should diminish along the progress of the pattern.

4.

Please read also, the H&S pattern rules carefully

TRIANGLES

1. Triangles are usually intermediate patterns, but some times occur in long duration, which are much more significant.

2. Minimum requirement of a triangle is 4 reversal points, but sometimes triangles with six reversal points can also be seen.

3. The prices must break out between two thirds to three forth, the length of the triangle. If the prices do not break out even after three forth of the length of the triangle then the triangle has lost significance.

4. A return move can be expected towards the broken line.

5. A broken line reverses its rule after the break out. ie in an uptrend, the resistance line ( the upper line ) is broken. But after the break out, the upper line becomes the support line.

6. Diminishing volume rule applies.

7. As in the reversal patterns, to confirm an uptrend continuity, the volume should be more in upward movements within the triangles. This is more significant in uptrend confirmations than down trend confirmations.

Symmetrical Triangle

1. Referring to the fig above, only after fixing the fourth point, the symmetrical triangle formation can be confirmed.

2. The two third to three forth break out rule applies here.

3. Diminishing volume rule applies.

4. Rule 7 for the Triangles to be followed.

5. To measure the movement, draw a trend line as shown in the fig below, then follow the channel measurement rule. Please read also, the H&S pattern rules carefully.

Ascending Triangle

1. This pattern indicates there are more strength in buyers than sellers. And is generally considered as as a bullish pattern.

2. It works as a consolidation, and a trend confirming pattern in a bullish trend.

3. Break out move normally happens with heavy volume, return move with light volume can be expected.

4. The minimum target distance after the break out can be taken as the width of the triangle base.

5. Diminishing volume rule applies. But the strength of the volume should be slightly tilted towards the upward movements. Please read also, the H&S pattern rules carefully.

6. These triangles are more of an intermediate pattern, with long terms, rare. Short term formations are called Pennants, which are discussed shortly.

Descending Triangle

Descending triangle follows the exact same rule as that of the ascending triangle as it is a mirror image of the ascending triangle.

Ascending and Descending Triangles as trend reversing patterns.

1. Both ascending and descending triangles sometimes appears as topping and bottoming patterns.

2. If an ascending triangle appears at the end of a down trend, and if a break out happens, then a trend change can happen. Same for the descending triangles which appear at market tops. Remembering rule 7 for triangles helps.

BROADENING FORMATION

1. This is a relatively rare pattern.

2. The volume tends to increase along the formation of the pattern.

3. This situation signals a market which is out of control.

4. It occurs when public participation is very high, especially at major market tops. It normally occurs at the end of major bull markets and is a bearish pattern.

FLAGS AND PENNANTS

1. Flags and pennants are quite common, are similar in appearances, occur at about the same place in an existing trend, and have same characteristics.

2. They occur when market pauses briefly to catch breath after a steep move with heavy volume. when they are at the process of formation, the volume declines, then again bursts on a break out.

3. They rarely produce a trend reversal.

4. Flag is a parallelogram with a slop against the slope of the trend.

5. Pennant is a small symmetrical triangle.

6. The volume should decrease along the formation of the pattern. and the break out should be with heavier volume.

7. They take shorter time to form usually two to three weeks, down trend patterns are shorter in duration.

8. Both the patterns are formed in the mid point of a market trend.

WEDGE PATTERN

1. Wedge pattern follows all the rules of the triangle pattern, except its implications and rules cited below. Please read also, the H&S pattern rules carefully.

2. The wedge pattern has a noticeable slant.

3. A down ward slopping wedge is a bullish pattern, and vice versa.

WEDGE REVERSAL PATTERN

Since a falling wedge is a bullish pattern, when it occurs at the end of a bear market, it might signal a trend reversal and vice versa.

RECTANGLE PATTERN

1. Rectangle is a trading range, a congestion area.

2. Rectangle pattern with 6 price swings, can be misinterpreted as a triple top reversal. Triple top reversal volume rules needs to be checked and the pattern ruled out, before confirming a rectangular pattern. Normally the rectangular patter resolves towards the trend direction. However, the direction of the heavier volume side determines to which side the rectangle break out finally will happen.

3. Minimum target rule follows the channel minimum target rules. Please read also, the H&S pattern rules carefully.

CONTINUATION HEAD AND SHOULDERS PATTERN

1. The continuation H& S pattern forms inverted to the reversal version in a continuing trends.

2. However the rules follow that of the rectangle formation.

.JPG)